Contents

0. Overview

We have two major contributions for our entrepreneurship section. First, we have written a business plan. In this plan, we assess the prospects of a firm using our biotINK bioprinting technology. To gain in-depth industry insights we interviewed experts and possible collaboration partners.

The second contribution is our Supporting Entrepreneurship study. In this study we identify factors that enable iGEM teams to found a new company. We derived the driving factors from several interviews and conducted a large-scale online survey among former and this year’s iGEM participants. The interviews enabled us to understand the causal relationships and we applied a statistical model to analyze the survey results. Both helps us to understand and quantify what differentiates teams that founded a start-up from non-founders. We merged our findings and developed a set of advices on how the iGEM community can improve the transfer from promising projects to viable ventures.

During our project, we pursued a twofold strategy that incorporates both approaches mentioned above. On the one hand, from the beginning of our wet lab work we aimed on getting a prototype to work. With a functioning prototype for the Giant Jamboree, we successfully proved our concept of our 3D-tissue printing method. We put a main emphasis on developing a working prototype to be able to discuss the potential of a new venture with investors after the iGEM competition. Together with the comprehensive business plan that we present below we have a working technology as well as a viable business model. Both will help us to determine the viability of our project in a competitive industry environment.

We are aware that founding a new company is a big challenge. What struck us the most, is the small number of start-ups that have been founded from iGEM teams – although there are numerous projects that are highly interesting not only from a scientific but also from a commercial point of view. Therefore, we strived to get an even deeper insight what enabled iGEM teams to found a new firm. The extensive results are presented on Supporting Entrepreneurship. We use the insights that we gained to improve on our way to the founding of a new company. Furthermore, beyond sharing the results we derived advices for iGEM. These advices wil help to increase the number of start-ups from iGEM teams. With these advices, we strive to increase iGEM’s footprint beyond the competition and shape the career of it’s participants.

1. Executive Summary

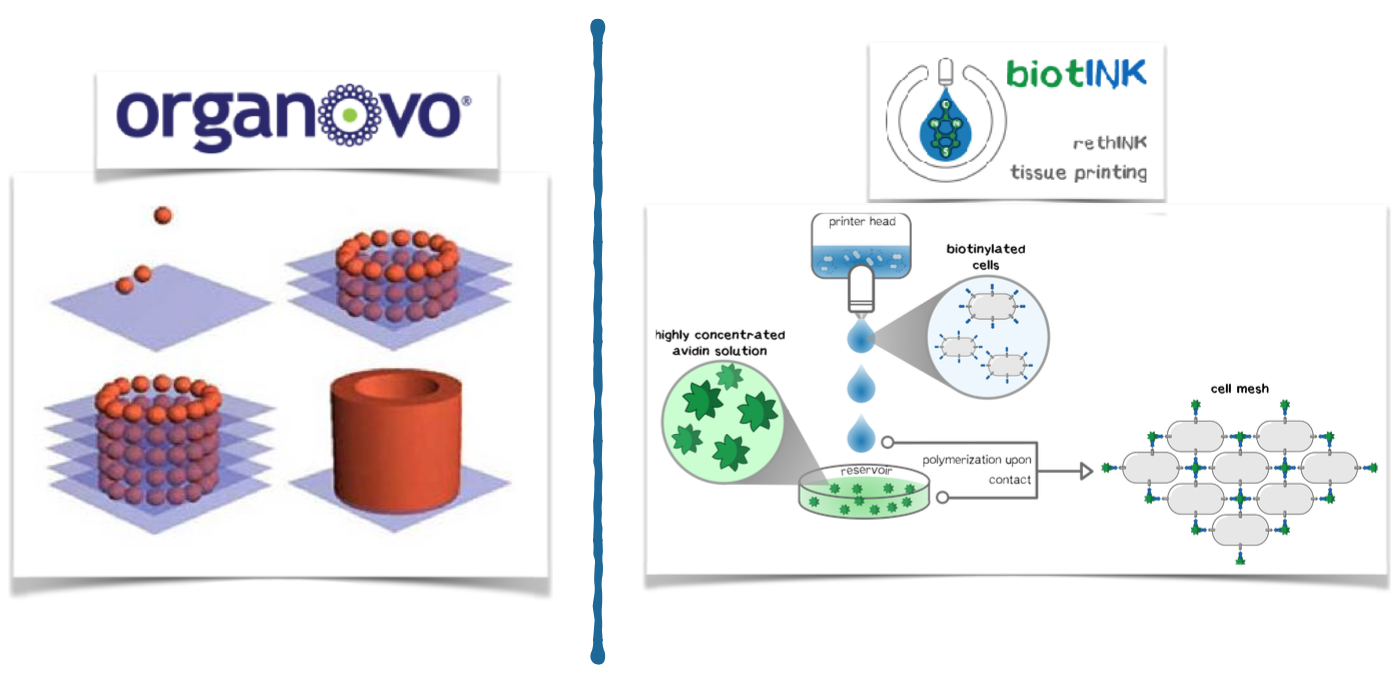

3D printing is currently revolutionizing many industries as well as the biotech sector. We build on this trend in order to bring our revolutionary technology to the market. To this end, we genetically engineer cells to make them produce a "glue" that connects these cells within milliseconds in order to build stable and living tissues by 3D printing.

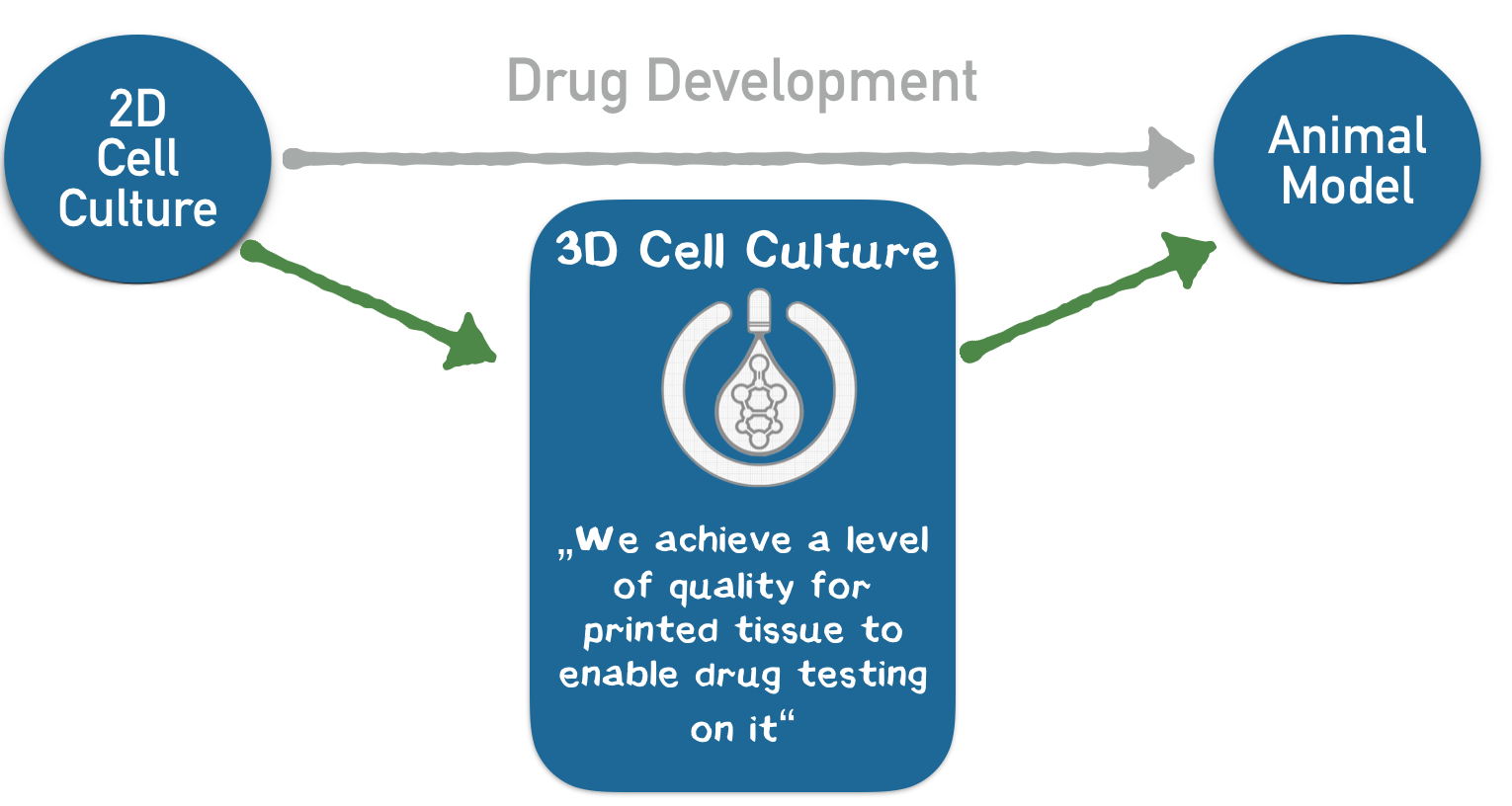

We aim to introduce this technology to the pharmaceutical industry. Drugs are developed over a span of 10 years, and the whole process costs up to $ 3 billion. Both these factors stem from the lack of appropriate testing systems for drug candidates. Our printed tissues should be applied subsequent to 2D cell culture screening and before animal testing in order to identify promising drug candidates at an early stage and thus solve the customer's problem of cost and time in drug development.

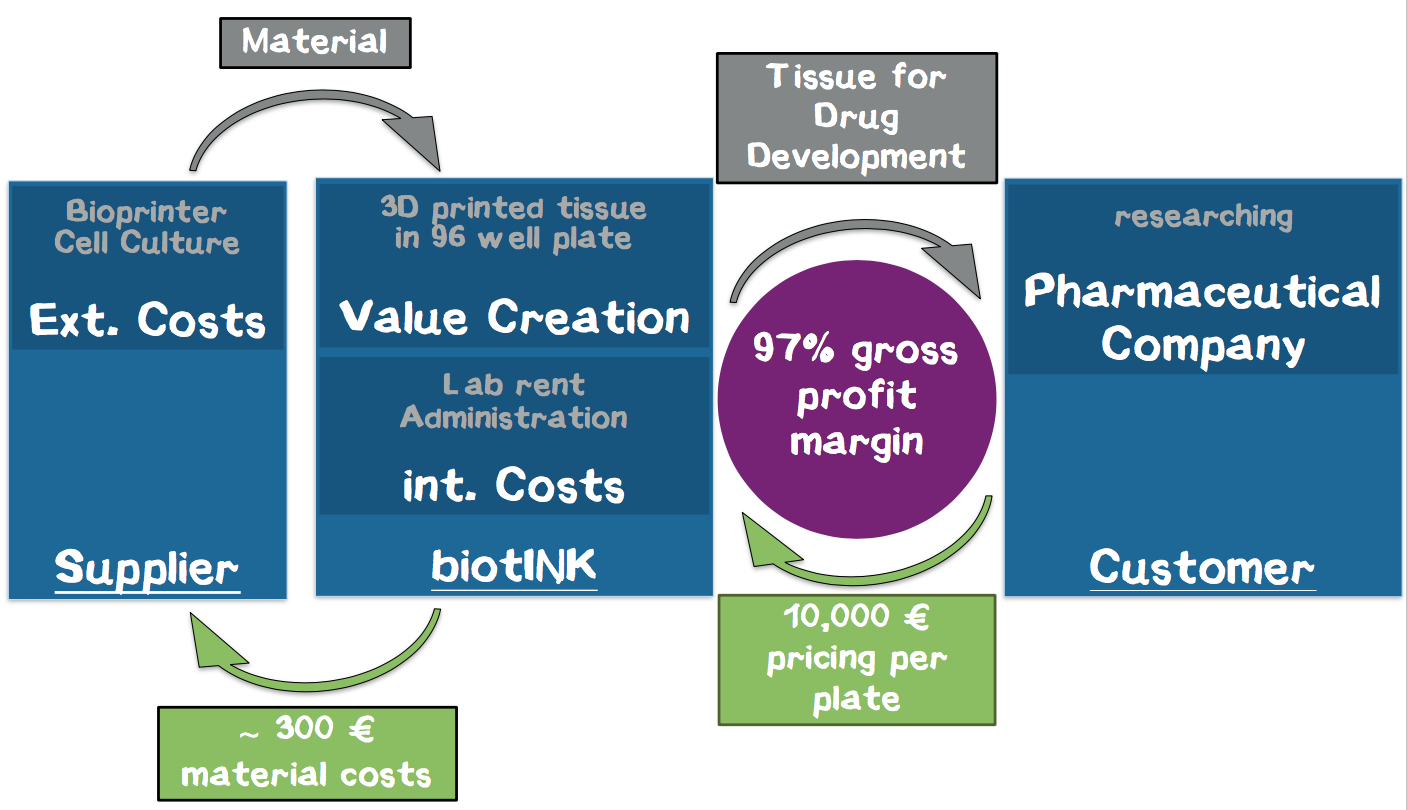

In our business model, we print liver tissue into a 96-well plate and provide it to our customers from the pharmaceutical industry for toxicity studies in the context of drug development. These pieces of tissue constitute customized “mini-organs” for specific drug testing. For the first time, our technology allows us to achieve a quality of printed tissue that enables our customers to use these tissues in the drug development process, which corresponds to our USP. Thus, we enable our customers to develop drugs faster, with lower opportunity costs and less animal testing. We expect annual sales of 400–500 panels for a single strategic partner within the first year. Based on our interviews, a price of € 10,000 per plate is adequate, corresponding to a turnover of € 4–5 million with a gross profit margin of about 97% without taking further investment costs for business development into account.

Within the total market for cell-based drug development, our target market is located in cells and tissues. This target market exhibits a total market volume of $ 100 million today and will grow to $ 300 million by 2019. Based on our interview, company B would be the first potential customer as soon as the results have been scientifically validated.

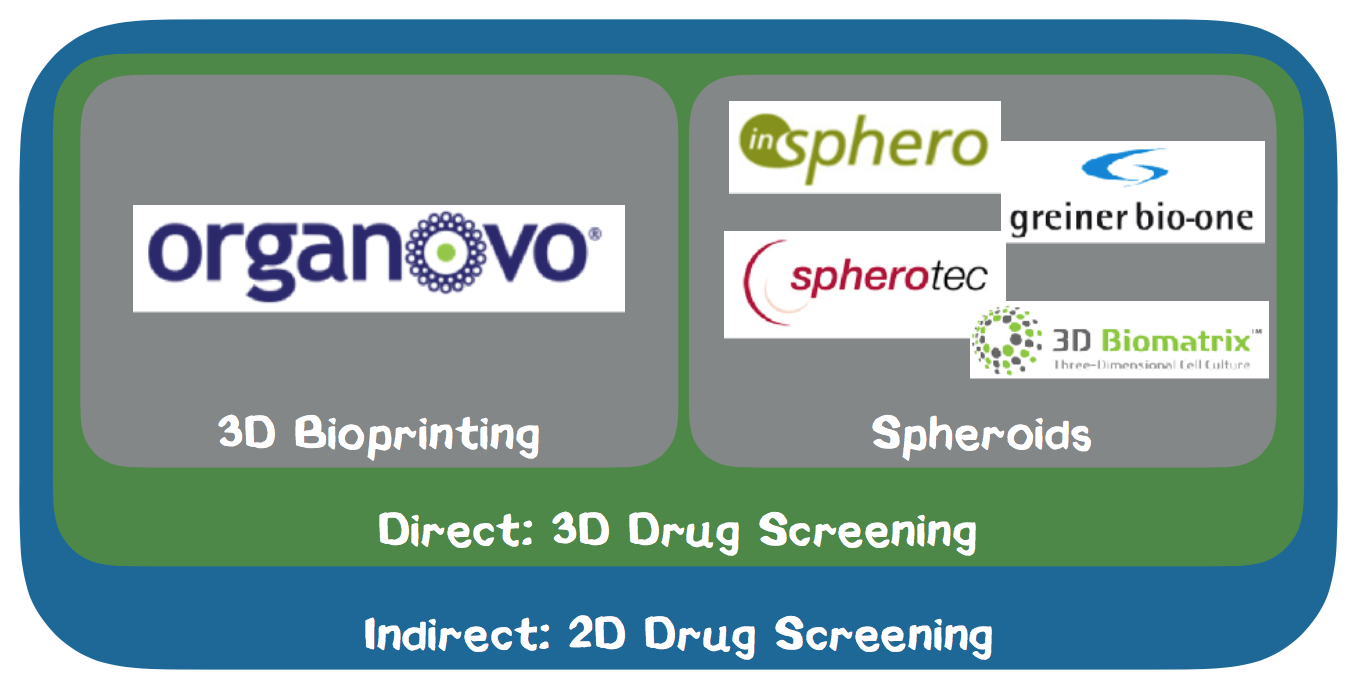

The competition is heterogeneous. Numerous indirect competitors act in the field of drug development by providing their customers with e.g. 2D cell cultures. Direct competitors are exclusively linked to the 3D cell culture area. Among these direct competitors, we consider Organovo to be our closest rival. Organovo also produces 3D bioprinting products for the pharmaceutical industry, but based on a significantly less powerful technology. Our printed tissues stand out by a significantly higher accuracy, stability and flexibility compared to competitors. In cooperation with the Technical University of Munich, a patent application is currently being considered.

2. Product and Customer

The development of drugs by the pharmaceutical industry today is performed in different stages. Before drugs are eligible for testing in humans, they must be investigated by cell-based assays and animal experiments. During the first step of this pre-clinical stage, thousands of substances are screened for a desired effect and potential health risks that might disqualify them for market approval. Usually, only a few of these candidates are tested in animals and even less make it to the clinical studies, where they are tested on human patients (Appendix 2). Often, candidates still fail during the clinical studies after hundreds of millions have been invested, resulting in tremendous financial costs for the companies. The costs for the development of a single drug have been calculated by many market analyses to be between 1.4 and 2.6 billion dollars. Large cost factors are failing drug candidates and opportunity costs (Appendix 2).

Customer. The target customer for our product is a large pharmaceutical company facing the problem that today’s models for drug discovery and testing, namely 2D cell cultures and animal testing, fail to reliably confirm the impact of the drug on the human body. 2D cell models are not dependable because cells exhibit their typical functions and behavior only under conditions that mimic those in the human body, for example they need to be surrounded by specific cells in all directions as is the case in an organ. Furthermore, animals are, for most applications, not sufficiently similar to humans to obtain meaningful insights about the effect of the drug. Nevertheless, many animals are still used for scientific experiments, especially in the area of drug testing. According to a study, 95% of drugs that work in animals are ineffective in humans (Appendix Ref. 1).

The main problem of our customer is that they are forced to spend millions or even billions of dollars to assess drug candidates that often do not work in humans or even expose volunteers for clinical studies to serious health risks because there are no reliable models for the pre-clinical drug development to verify safety and effectivity. In order to reduce these enormous costs for the development of drugs, our customers need dependable systems that can distinguish drug candidates with high chances of success from candidates that will likely fail in humans. Our solution for the customers problem is providing a reliable 3D-structured cell culture test systems with a new level of quality to investigate the effects of drug candidates. With our modified printer, we are able to precisely print and connect cells to 3D structures without harming the cells.

Reducing costs and time during the drug development process by means of our product is the most important benefit for our customers. Moreover, the number of animals used for experiments is reduced because several drug candidates will be excluded early on. As decided by the EU parliament in 2010, it is planned to reduce the amount of animals used for drug development within the next years (Appendix Ref. 1). Since 1980, the German government has financed over 500 projects to find alternative ways to reduce the amount of animals used for experiments with over € 160 million (Appendix Ref. 2) Our product contribute to this goal and is an opportunity for the pharmaceutical industry to meet upcoming governmental guidelines and improve their reputation. Furthermore, the number of expensive clinical studies in humans, which put many volunteers at risk, may be reduced as well. A suitable measure for the impact of our product on the industry is, for one, the amount of money saved from identifying substances that will fail market approval. For another, we can consider how many animals are saved. Additionally, 3D cell structures live longer than 2D models, which is preferable for longer tests, and they are also more robust, which is highly favorable for the customer in terms of storage and transportation. Another advantage of our product over other approaches is that we might be able to arrange the cells into a great variety of shapes and even connect different types of cells that are usually difficult to connect under laboratory conditions.

The feedback from the interviews (protocols attached in appendix, pages 22 through 30) about the idea behind our technology was consistently positive. Moreover, the hypothesis (Appendix 1) that reliable 3D cell models are requested by the industry was confirmed. The ability to print the cells in a great variety of shapes and connecting different cell-types (co-cultures) is of high interest to our interview partners. The different partners even emphasized that a product with adequate quality and reliability is not yet on the market. As interviews with different pharmaceutical companies confirmed, the best stage to use our product in drug development will be after the initial high-throughput screening of candidates in 2D cell culture is completed. Our product will be used after 2D cell culture screenings but before the candidates are tested in animal models. Another interesting result of the interviews is that a price of up to € 10,000 for one 96-well plate with our cells is realistic. The majority of people confirmed that, in this particular industry, the price is practically irrelevant if the quality of the product is high and solves the customer’s problem. In company B, we have acquired our first potential customer. Person B, head of the in-vitro pharmacology and toxicology department at company B emphasized that we have aroused great interest and that they might test our prototype within their product development process.

Product. We offer ready-to-use 96-well plates equipped with 3D-arranged liver cells for pre-clinical drug development and toxicity screening. For the first product type, we have chosen liver cells because liver toxicity is one of the most frequent reasons for drug candidates to fail in later stages of drug development. We offer our cells in 96-well plates because they are the industrial standard for most laboratory applications. In the future, other cell lines will also be established.

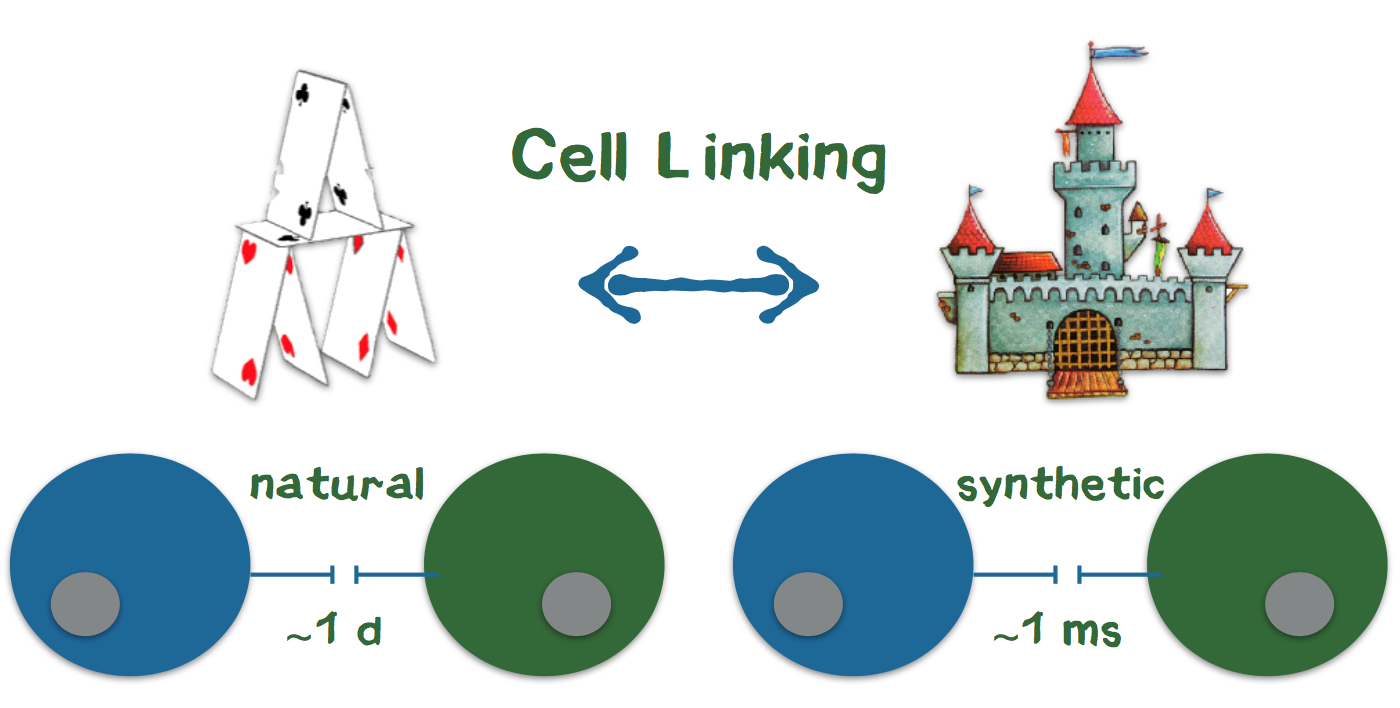

3D printing is currently revolutionizing many industries such as biotechnology. Very recently, there have been considerations to arrange cells in defined 3D structures by printing. One of the largest obstacles for arranging cells in a 3D structure is that cells need up to one day to connect to each other and form a stable structure. In contrast, precise 3D printing of materials like plastic is possible because the liquid plastic sticks together and quickly hardens after printing. To connect the cells during the printing process like plastic, we are developing genetically modified cells that adhere to each other in the presence of two additional components (Appendix 4). We use a 3D printer to print the cells into the cavities of a culture plate. Since the cells and additional components are brought together while printing, the cells stick together directly after they are printed. Our technology bases on the biotin-streptavidin interaction, which is one of the strongest and fastest known reactions in biochemistry. Using this technology, our USP is, to produce cells in 3D structures at a quality level that is unprecedented with conventional 3D-printing technologies. Owing to this level of quality, the benefit of high information value that prevents further investment into failing drug candidates exceeds the costs of our product as a system for additional cell culture screening. Most of the companies that were interviewed stated that the genetic modification might be a problem for customers. Thus, we aim to introduce the genetic information for the component that mediates the connection only temporarily via messenger RNA, which does not integrate into the genome.

At the moment, the technology is developed by a team of students that participate in the iGEM competition, hosted by the MIT in Boston (Massachusetts, USA). Several basic experiments on the principle of connecting two cells under the printing conditions have been performed successfully. A prototype consisting of a 96-well plate filled with cell culture medium and small printed pieces of plastic to represent the cell structure was created to visualize what our product will look like (Appendix 3). During the next months, the goal is to produce the first genetically modified cells and to show that the technology for assembling the cells works. We consulted the Office for Research and Innovation of the TU Munich to discuss the patentability of our project. A decision is under way to initiate examination for patentability and patent application via the TUM in exchange for shares of the invention (Appendix 10). In order to win the acceptance of the product, it might be necessary to perform studies that prove that these 3D-structured cells are able to identify, for example, liver-toxic drugs that do not show toxicity in 2D cell culture.

3. Entrepreneurial team

We met and formed our team at the „Idea Vernissage“ (Appendix 11, initial poster). Christoph Gruber, who provided the idea and is also our project leader, is a member of the LMU-TUM team participating in this year’s iGEM competition (https://igem.org/About). Christoph Gruber and Christoph Bach both study Molecular Biotechnology, thus providing our team with indispensable scientific knowledge.

Christoph Gruber works in a company within the company B conglomerate. As such, he is in contact with our first potential customer company B and has a reliable network of contacts. He also keeps us updated on the results from the iGEM lab and knows when to adapt our direction to the new findings.

Christoph Bach is experienced with scientific research and highly competent in talking to our customers about the technology.

Paul Kurz is studying Technology and Management and provides the team with the necessary knowhow in economic aspects of the idea, such as financial calculation and reasonability of investments.

Carolin Hecking-Veltman studies Engineering Science and has great experience in Business Design based on her activity in the Manage&More program.

Vincent Nöthen studies Mechanical Engineering and supplies knowledge about 3D printing. Furthermore, he is very well networked in the “Verband Deutscher Ingenieure” and knows many possibly helpful contact persons for our project.

4. Market and Competition

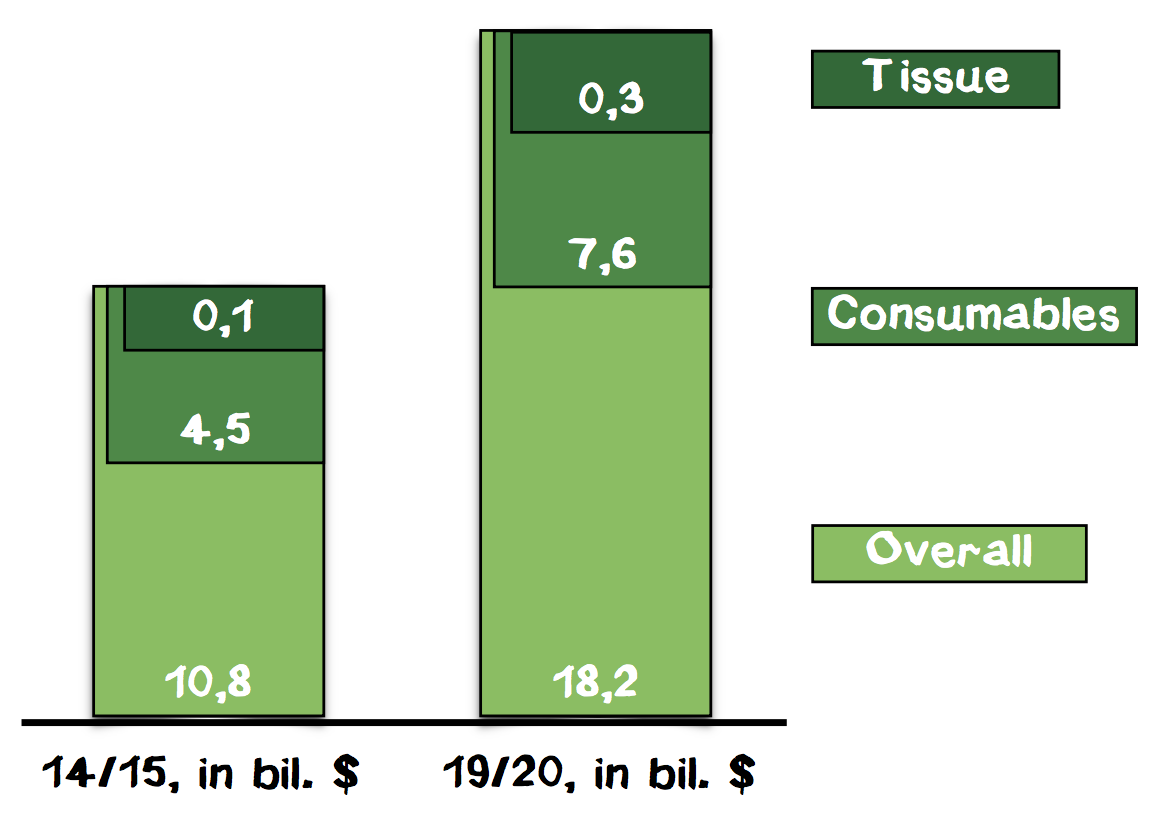

In this total market, we focus on the segment of 3D cell structures. According to a market analysis of BBC Research, the market for 3D cell culture was valued at $586 million in 2014 and is forecasted to grow to $2.2 billion until 2019, showing a 5-year CAGR of 30.1%. The segment of cells and tissues will grow from around $100 million in 2014 to around $300 million in 2019 (Appendix 9). Although, for the time being, the market of consumables within cell-based assays should be considered the total market, it might be important to monitor the market of 3D cell culture as well because in the future our technology could be used for other applications in this field.

During the interviews with different companies, we were also seeking a potential first customer. The Head of in-vitro pharmacology and toxicology at company B was highly interested in our product. In case of a successful proof-of-principle of our technology, a further presentation was requested. The interviews led to the conclusion that, in contrast to basic research, the pharmaceutical industry is willing to pay much money for cell-based assays as long as they provide them with valid information about the tested drug candidates and save them money in the long run by reducing the number of animal models or even clinical studies. Adoption barriers might be tough in establishing acceptance of the product. It might be necessary to perform studies that show the successful distinction between failing and approved candidates that all seemed promising during 2D cell culture tests.

Competitor Analysis. As the market for bioprinting technologies of living cells is currently evolving quickly, the market has not yet been diversified (Appendix 8.). We do not regard any manufacturers of hardware components for 3D printers in the biotech field as direct or indirect competitors as we are not a hardware company but selling a holistic solution for drug testing. On the other hand, companies that actively sell drug testing solutions based on 2D cell cultures are our primary indirect competitors. We consider companies which also provide 3D cell cultures for drug testing our direct competitors. Within our direct competition, we distinguish between companies who deliver 3D cell cultures based on 3D printing and spheroid technology. As we are streamlining our competencies on the production of liver cells into a standardized version, we are not targeting the ordinary tissue engineering market but the market for preclinical drug testing in the pharmaceutical industry.

In the following we analyze our direct competitors based on the spheroid method. The spheroid cultures are mostly generated by the so-called hanging drop method, which is a technology based on gravity. The cell culture medium is poured onto the upper level of a cell plate, and in each well a small drop forms. Greiner Bio One International GmbH is a leading global partner in the fields of biotechnology, diagnostics, medical devices and in-vitro diagnostics based in Austria. At the ANALYTICA 2016 trade fair in Munich, we had the opportunity to talk to one of their sales managers, who gave us detailed information about the product. Greiner offers spheroid cultures to closely reflect the in-vivo tumor microenvironment. The spheroid cultures are produced by magnetic forces which hold the cells in a stationary position. InSphero AG is a Swiss start-up founded in 2009, which has already won several awards and distributes standardized 3D microtissue models based on the hanging drop method. The activities of SpheroTec GmbH, a spin-off of the TUM and 3D Biomatrix, Inc. provide similar solutions. The disadvantages of spheroid cell cultures are the irregular arrangement of the cells, so that the final tissue structure cannot be actively controlled. Furthermore, it is only possible to use a single cell type, whereas the 3D printing method allows us to mix different cell types.

5. Marketing and Sales

Our users are our customers, the pharmaceutical companies who buy and use our product. We sell it to them directly for using it in drug discovery. However, our customer is not only our user, but also our partner. Starting with one customer, they are our strategic partner. In the beginning, we are fully dependent on their orders because we start with one customer only. The most demanding actors in this market are the legal authorities like the EMA (European Medicines Agency) or the FDA (Food & Drug Administration), which are both responsible for every new drug that is delivered to and spread in the market. Since we only have one customer we sell to directly, our plan is to build our laboratory near, if not inside, their site of work to lower the costs of logistics like shipping in the beginning.

Essential for our market entry is the cooperation with one pharmaceutical company that implements our models into their process. In the course of our interviews, we obtained our potential first customer: company B, which conducts the first stage of research (2D cell culture & animal testing) for the drug discovery of other pharmaceutical firms. We see company B as our pilot customer to obtain firsthand experience and results that we can develop further. After the first fine-tuning, our customer acquisition costs are participation fees for large conferences or fairs to spread the word of our product. Furthermore, legal authorities completing standard conditions not only for laboratories but also the product itself entails high costs to convince potential customers that our product is safe and approved by, for example, the EMA (European Medicines Agency). This approval is granted after a sequence of studies and results of research.

In the context of pricing, we would like to highlight two key quotes from our interviews:

- CTO of Company A: "In the pharmaceutical industry, you set the price by yourself. If your product serves the need of a customer, he pays more than enough to use your product. We sell our products to different customers with a price range of over almost € 50,000. One advice: Just don't go too low with your price!"

- Head of Research of company C: "A five-digit price is more than acceptable for your product."

6. Business Model

Based on the business model canvas in appendix 5 we split our business model into seven parts:

Key Activities. We sell 96-well plates with individualized 3D cell structures to pharmaceutical companies for drug testing. Our USP bases on the statement that our 3D-printed cell structures are the first feasible and reliable 3D models for drug testing that greatly improve the viability of in-vitro tests before animal tests (Appendix 6: Positioning Statement). The models will consist of liver cells. The great majority of all drugs is first processed in the liver, which is why toxicology tests are usually performed first on liver cells. Our hypothesis that this kind of cells promises the greatest market potential for us was confirmed in the interview with company B. We plan on offering one standardized version with liver cells and an excellent quality that can be individualized completely by the customer to enable tests for certain diseases with genetically engineered cell lines.

Customer Segment. Our primary customer segment are pharmaceutical companies and service providers conducting pre-animal drug testing. Their great advantage for us as customers is the high willingness to pay and the high demand they have for testing material. Research institutes may be a possible additional customer segment at a later point. Our product is localized in the pharmaceutical industry and we are in the B2B market. We produce the 3D structures according to the customer’s wishes and prepare them for the tests using the standardized 96-well plates. As visualized in Appendix below we buy 3D printers, the medium for the cells, the plates and the prepared cell cultures from suppliers. In the beginning there will be a high investment for the 3D printers. We considered this investment in our calculation (Appendix 7).

Key Ressources. We produce our models in a rented laboratory and need employees to operate the 3D printers as well as the remaining laboratory activities. Moreover, we take our costs for research and further development of our technology into account.

Value Proposition. We create value by printing the unstructured cells we buy from our supplier into the 96-Well-Plates and thus improving our customers’ test results. Thus, we reduce the number of necessary animal tests and save our customer time and opportunity costs.

Customer Relationship and Channels. Our business is highly sales and less marketing orientated due to the need for explanation of the product. Therefore we seek to have a strong sales team and intense contact to our customers. Our distribution chanel is either bei shiping per specialsed logistic partner our inhouse production at our customers facility.

Cost Structure. Our major cost drivers are the rent for the laboratory, laboratory costs, and material costs for the cell medium. An additional high investment in the beginning are the 3D printers. Our current calculation resulted in a cost of about € 242 per plate. We calculated that each printer can print 3 plates per day, and we believe that a single printer is a reasonable number to start with. Thus, we are able to produce about 600 plates per year, which perfectly fits to the calculated needs of the strategic partner we plan to exclusively supply during the first year. A detailed calculation of the costs and revenue streams can be found in the appendix (Appendix 7).

Revenue. Our revenue stream is our customers purchasing the plates. To calculate the amount of our product that we can sell to them in one year, we expect that usually 2–3 drug candidates can be screened on one 96-well plate. Since usually around 30 drug targets with 30 potential compounds for each target are present in a pharmaceutical pipeline, the required number of 96-well plates is around 400–500. From interviews, we gained the impression that we can demand about € 10,000 for one plate. Therefore, we calculate with a turnover of € 4–5 million. Altogether, we expect a satisfactory gross profit margin of 97%.